News

SBCVC Honored at 2017 China Venture Awards

SBCVC was listed on the "Top 10 Foreign Investors of the Year 2017" and "Top 20 Venture Capital Firms of the Year 2017" at the CVINFO's China Venture Capital & Private Equity Awarding ceremony on April 23-25, 2018.

The event, organized by China Venture Info (CVINFO), the top investment research and consulting institute in China, recognized top investment firms and investors in China. Over the past year, the philosophy of value investment in China’s capital market has been deep-rooted.

SBCVC was proud to accept below awards recognizing its outstanding investment results and professional investment team.

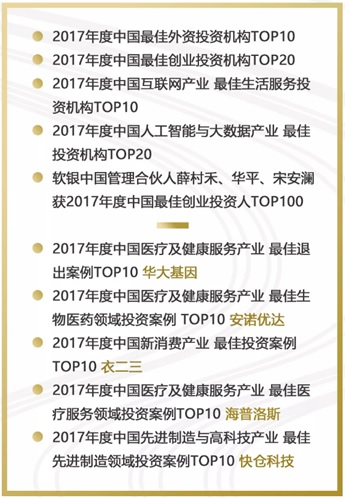

SBCVC:

Top 10 Foreign Investors of the Year 2017

Top 20 Venture Capital Firms of the Year 2017

Top 10 Life Service Investors in Internet Industry of the Year 2017

Top 20 Investors in AI and Big Data Industry of the Year 2017

SBCVC Managing Partners Chauncey Shey, Peter Hua and Alan Song are listed on the Top 100 Venture Capitalists of the Year 2017

SBCVC Portfolio Companies:

BGI, Top 10 Exit Cases in Medical Treatment and Health Service Industry of the Year 2017

Annoroad, Top 10 Bio-medical Investment Cases in Medical Treatment and Health Service Industry of the Year 2017

YCLOSET, Top 10 Investment Cases in New Consumption Industry of the Year 2017

HaploX, Top 10 Medical Service Investment Cases in Medical Treatment and Health Service Industry of the Year 2017

Quicktron, Top 10 Advanced Manufacturing Investment Cases in Advanced Manufacturing and High-tech Industry of the Year 2017

The CV AWARDS has been existed for more than a decade and deemed as a benchmark of respective segments.

The ranking was developed by CVINFO Research Institute on the basis of CVINFO research and its powerful data system. Through the process of questionnaire survey, interview, data screening, summarization and verification, etc., the Research Institute standardized all data and decided the rankings by overall scores to define the most authoritative, comprehensive and objective list of the industry. After data screening and survey in five months, CVINFO Research Institute also released the investment trends and focuses based on the list at the summit.

IPO of Chinese enterprises was a hot topic in 2017. Shown by the IPO exit in terms of sector, finance and manufacturing are the top two sectors with the largest IPO scale, followed by medical treatment and health, Internet and new energy.

Shown by CVINFO's sector list, medical treatment and health, Internet and advanced manufacturing are three sectors most favored by investment institutions, with the proportions of investment quantity of 19%, 18% and 11% respectively.

It coincides with the accelerated investment sectors of SBCVC over the years.

In the session of "Top Dialog" on April 23, SBCVC Managing Partner Dr. Peter Hua concluded three decisive factors of the core competitiveness of an entity: the investment strategy and focus, the establishment of a professional team and the stability of the team.

As a well-established foreign investment institution, SBCVC has been deeply rooted in Chinese market for 18 years and always concentrating on the core areas of innovative technologies. By expanding presence in such sectors as TMT, health and medical treatment, new materials, energy conservation, etc., SBCVC has made successful investments in quite a number of excellent enterprises of high growth and high technology. In the meantime, SBCVC team boasts abundant operation experience and profound technology background that boost its growth in many aspects like strategy development, market exploration, resource integration, talent introduction, etc. and also spur the rapid development of invested targets towards the final triumph. Looking ahead, SBCVC will join hands with excellent Chinese enterprises as always and incubate the next great business. The company will contribute more to the sustainable social development and witness the evolution of times.